san francisco gross receipts tax apportionment

On the next page click the File button next to Gross Receipts Tax and Homelessness Gross Receipts Tax Returns. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments.

The Nuances Of Market Based Sourcing Of Service Revenue Not All Markets Look The Same Pdf Free Download

APPORTIONMENT OF RECEIPTS BASED ON PAYROLL.

. While San Franciscos gross receipts tax went into effect beginning January 1 2014 confusion continues to linger regarding two aspects of the tax. 27 Gross Receipts Tax Ordinance 9541a. On November 6 San Francisco voters approved Measure E which imposes a gross receipts tax on persons engaged in business activities in San Francisco.

As someone who actually reads tax codes for a living yes I need. 1 The measure will. Reporting requirements and computation.

Gross Receipts Tax and Payroll Expense Tax. A For all persons required to. The purpose of this article is to provide a general overview of San Franciscos sourcing rules and their application to specific industries.

Complete the filing questionnaire. Administrative and Support Services. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business.

For the 2020 tax year non-exempt. Gross Receipts Tax Applicable to Private Education and Health Services. 831 Business Personal Property Tax payment due Assessor-Recorder Payable to.

Confusion with San Franciscos gross receipts tax centers on two aspects of the tax. Receipts from the sale of real property for which the Real Property Transfer Tax was paid B15. San Francisco voters decided to hike the citys gross receipts tax its primary business tax in November.

BUSINESS AND TAX REGULATIONS CODE. San Francisco Business and Tax Regulations Code. 29 Gross Receipts Tax Ordinance 960 and 961.

Lean more on how to submit these installments online to. In this Insight we we look at nexus the NAICS. 26 Gross Receipts Tax Ordinance 9523e.

Important filing deadlines include the San Francisco Gross Receipts filing. Persons other than lessors of residential real estate must file applicable Annual Business Tax Returns if they were engaged in business in San Francisco in 2021 as defined in Code section. Trust And Estate Administration.

And Miscellaneous Business Activities. Payroll Expense Tax. San francisco gross receipts tax instructions 2020 Tuesday February 22 2022 Edit.

28 Gross Receipts Tax Ordinance 9541b. San Francisco Gross Receipts Tax B14. Business Activities NAICS Codes.

Receipts from the sale of real property for which the Real Property Transfer Tax was paid B15. All persons deriving gross receipts from business activities both within and outside the City shall allocate andor apportion their gross receipts to the City using the rules set forth in Section. The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Payroll Expense Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax.

San Francisco Gross Receipts Tax B14. Therefore when you register for a San Francisco. Taxpayers deriving gross receipts from business activities both within and outside San Francisco must allocate andor apportion gross receipts to San.

In an effort to eliminate this perceived tax disincentive in November 2012 San Francisco voters passed Proposition E Prop E enacting the Gross Receipts Tax which went.

Annual Business Tax Returns 2019 Treasurer Tax Collector

Empirical Evidence On The Revenue Effects Of State Corporate Income Tax Policies Mary Ann Hofmann Academia Edu

Ending Confusion Over San Francisco S Gross Receipts Tax Silicon Valley Business Journal

S F Businesses Will Find Remote And Hybrid Work Are Going To Be Taxing Matters

Gross Receipts Tax And Business Registration Fees Ordinance Ppt Download

San Francisco Gross Receipts Tax Clarification

Due Dates For San Francisco Gross Receipts Tax

Getting To The Core Of Gross Receipts Taxes Salt Shaker

![]()

Getting To The Core Of Gross Receipts Taxes Salt Shaker

State Gross Receipts Tax Rates 2021 Tax Foundation

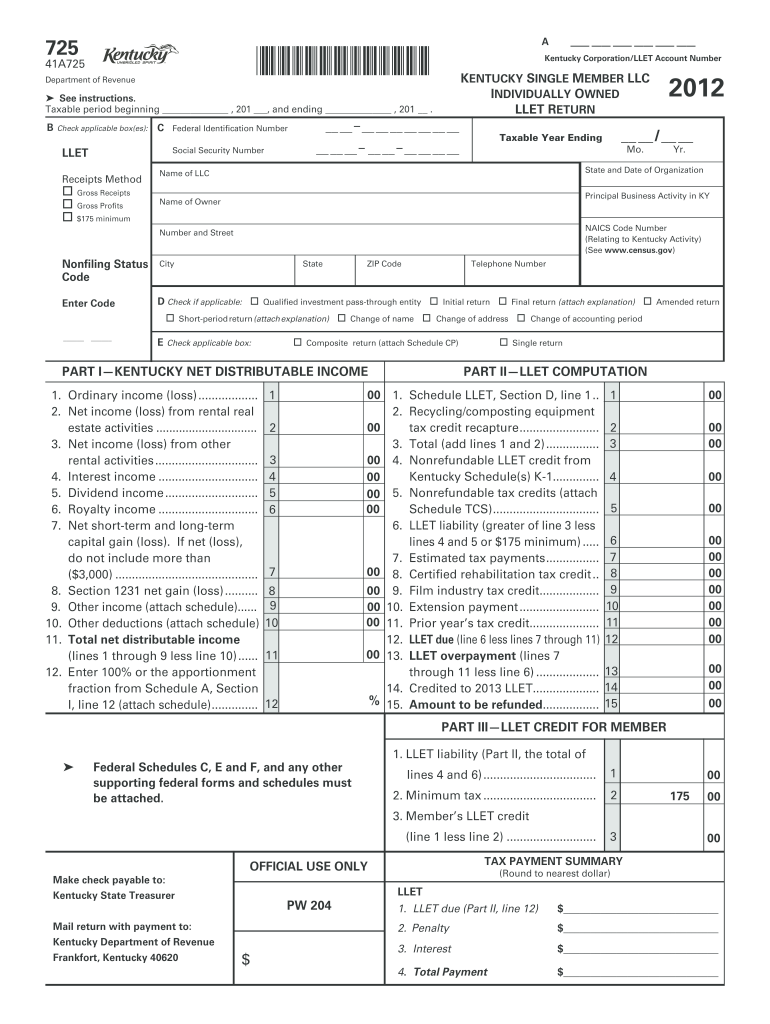

1600010256 Kentucky Department Of Revenue Fill Out Sign Online Dochub

Gross Receipts Tax Category Archives Seesalt Blog Published By State Local Tax Attorneys Pillsbury Winthrop Shaw Pittman Llp

Income Franchise Gross Receipts Tax Bdo Tax

San Francisco Begins Transition To Gross Receipts Tax The Bar Association Of San Francisco

State By State Guide Which States Have Gross Receipts Tax Taxvalet Sales Tax Done For You

San Francisco Taxes Filings Due February 28 2022 Pwc

San Francisco S Biggest Companies Now Forced To Pay A Homeless Tax

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us